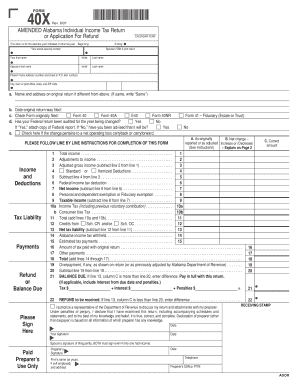

AL 40X 2008-2026 free printable template

Instructions and Help about AL 40X

How to edit AL 40X

How to fill out AL 40X

Latest updates to AL 40X

All You Need to Know About AL 40X

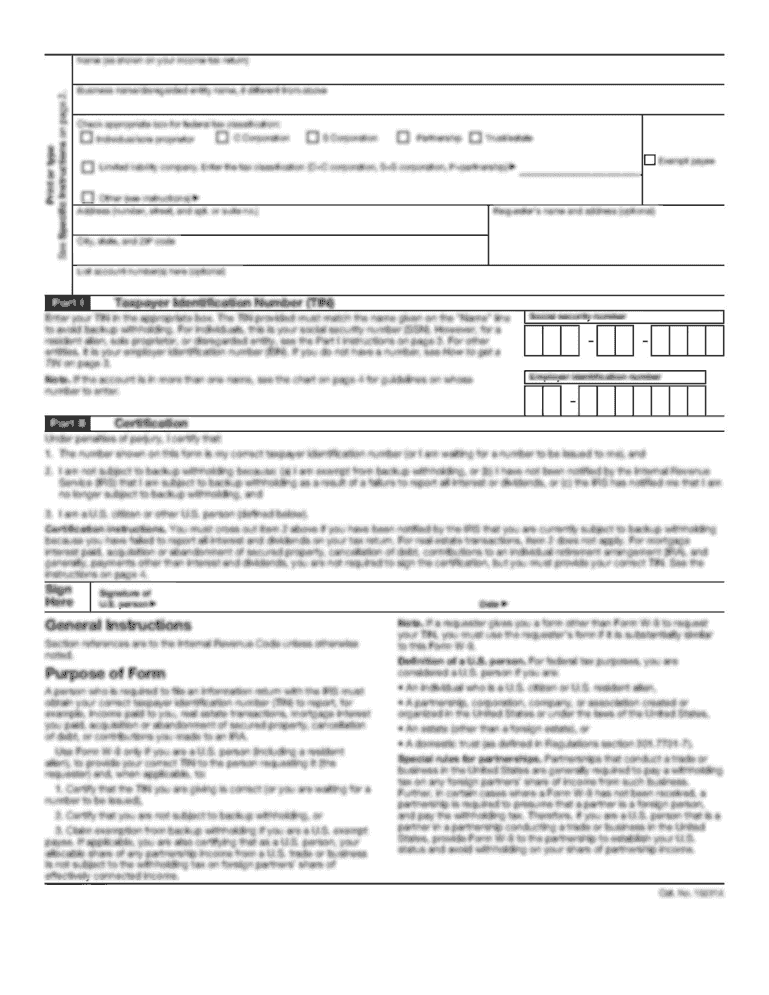

What is AL 40X?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about AL 40X

How can I correct mistakes after filing the AL 40X?

If you need to correct mistakes on your AL 40X after submission, you can submit an amended form. Ensure that you clearly indicate the changes made and provide any necessary explanations to avoid confusion. Keeping accurate records of your corrections and updates is essential to maintain compliance.

What is the best way to verify the status of my AL 40X filing?

To verify the status of your AL 40X filing, you can check the online tracking system provided by the tax authority. Additionally, some jurisdictions offer automated phone services that allow you to inquire about the processing of your form. Keep your confirmation number on hand for quick access.

What should I do if my AL 40X filing gets rejected?

If your AL 40X filing is rejected, promptly review the rejection codes provided to understand the reasons for the denial. You can then correct the issues and resubmit the form. It’s also advisable to check for possible discrepancies in your records that could have led to the rejection.

Are e-signatures acceptable when filing the AL 40X?

Yes, many jurisdictions accept e-signatures for the AL 40X, making it easier for online submissions. However, ensure that your e-signature complies with the specific requirements set by your local tax authority to avoid any potential issues.

What steps should I take if I receive an audit notice related to my AL 40X?

Upon receiving an audit notice for your AL 40X, gather all relevant documentation, including the original submission and any supporting materials. Respond promptly to the notice with the requested information, and consider consulting a tax professional if you have concerns about the audit process.