AL 40X 2008-2025 free printable template

Show details

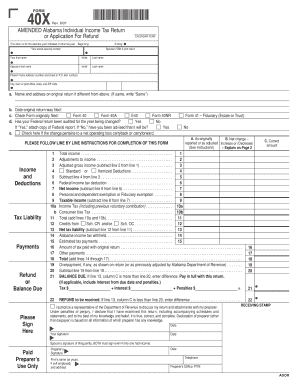

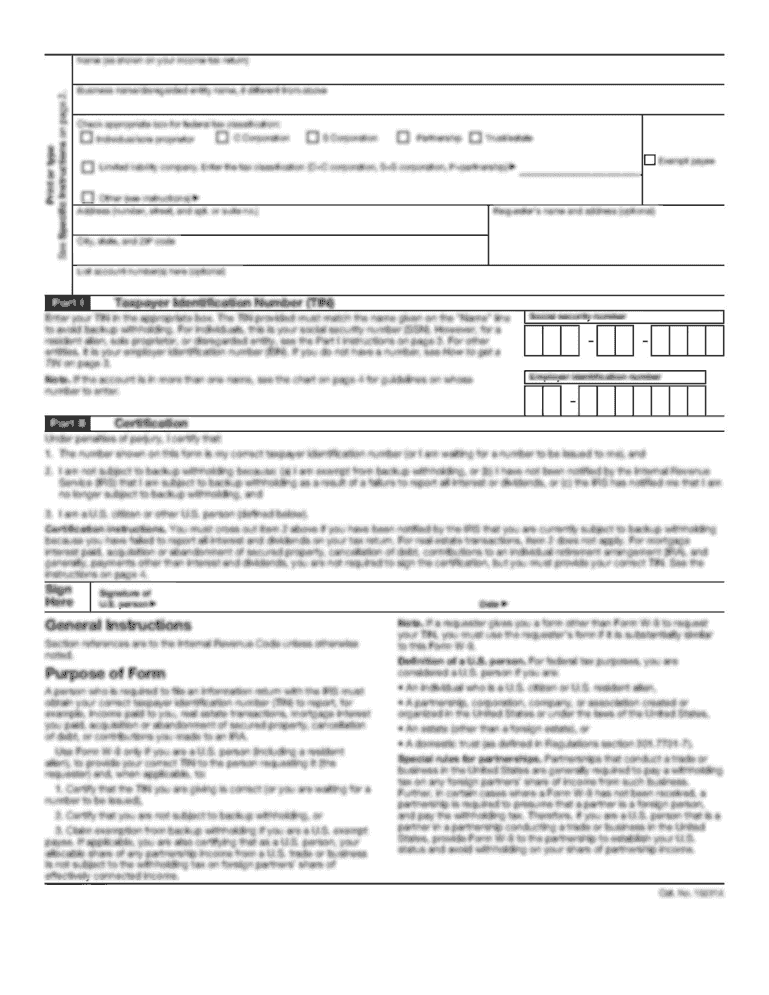

O. Box 327464 Montgomery AL 36132-7464 Do Not mail your current return with Form 40X it must be mailed to a different address. XX00014X FORM 40X Reset Form Rev* 6/08 AMENDED Alabama Individual Income Tax Return or Application For Refund CALENDAR YEAR Ending This return is for the calendar year indicated or other tax year Beginning Your social security number Spouse s SSN if joint return Your first name Initial Spouse s first name Last name USE ONLY FOR TAX YEARS PRIOR TO TAX YEAR 2008...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign return tax form

Edit your alabama form 40x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alabama form tax online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form federal tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL 40X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out alabama form

How to fill out AL 40X

01

Gather all necessary information including personal details and income sources.

02

Obtain the AL 40X form, either online or from a local office.

03

Start filling in your name, address, and identification number at the top of the form.

04

Input your income details in the designated sections, ensuring accuracy.

05

Add any deductions or credits you are eligible for as indicated on the form.

06

Review all entries for completeness and correctness before submitting.

07

Sign and date the form as required, and then submit it to the appropriate agency.

Who needs AL 40X?

01

Individuals who need to report and calculate their taxes for the year.

02

Residents who may qualify for tax deductions or credits.

03

Tax professionals assisting clients with their tax filing.

Fill

file federal tax

: Try Risk Free

People Also Ask about tax filed

How do I file an amended tax return online?

Here's a step-by-step guide. Step 1: Collect your documents. Gather your original tax return and any new documents needed to prepare your amended return. Step 2: Get the right forms. The IRS form for amending a return is Form 1040-X. Step 3: Fill out Form 1040-X. Step 4: Submit your amended forms.

How do I file an amended tax return in Alabama?

If you need to amend a local return, you can use a copy of your original return or contact the Department of Revenue at (334) 242-1490 to request a blank form to make the corrections to the applicable period.

What is a common reason for filing a 1040X?

If you didn't claim the correct filing status or you need to change your income, deductions, or credits, you should file an amended or corrected return using Form 1040-X, Amended U.S. Individual Income Tax Return.

Can you file Form 1040-X electronically?

Yes. If you need to amend your 2020, 2021 or 2022 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

How can I file a 1040-X?

Electronic Filing Now Available for Form 1040-X You can now file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 and 1040-SR, and 2021 or later Forms 1040-NR. For more details, see our June 2022 news release on this topic. Paper filing is still an option for Form 1040-X.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AL 40X from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your AL 40X into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in AL 40X without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing AL 40X and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the AL 40X electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your AL 40X in minutes.

What is AL 40X?

AL 40X is a tax form used in Alabama for specific tax purposes, often related to income and adjustments.

Who is required to file AL 40X?

Individuals or entities that need to report adjustments to their Alabama income tax filings may be required to file AL 40X.

How to fill out AL 40X?

To fill out AL 40X, provide the required personal and financial information, including details on the adjustments, and follow the instructions for completion.

What is the purpose of AL 40X?

The purpose of AL 40X is to report corrections or amendments to previously filed Alabama income tax returns.

What information must be reported on AL 40X?

AL 40X must report personal identification details, previous tax return information, adjustments being made, and the reasons for those adjustments.

Fill out your AL 40X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL 40x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.